By now it is well known that retention is where the real money💰💰 is. Those that failed to learn this lesson earlier have been forced to learn it the hard way in the current market.

I want to put this into a real life example to show the beauty of recurring revenue from existing customers.

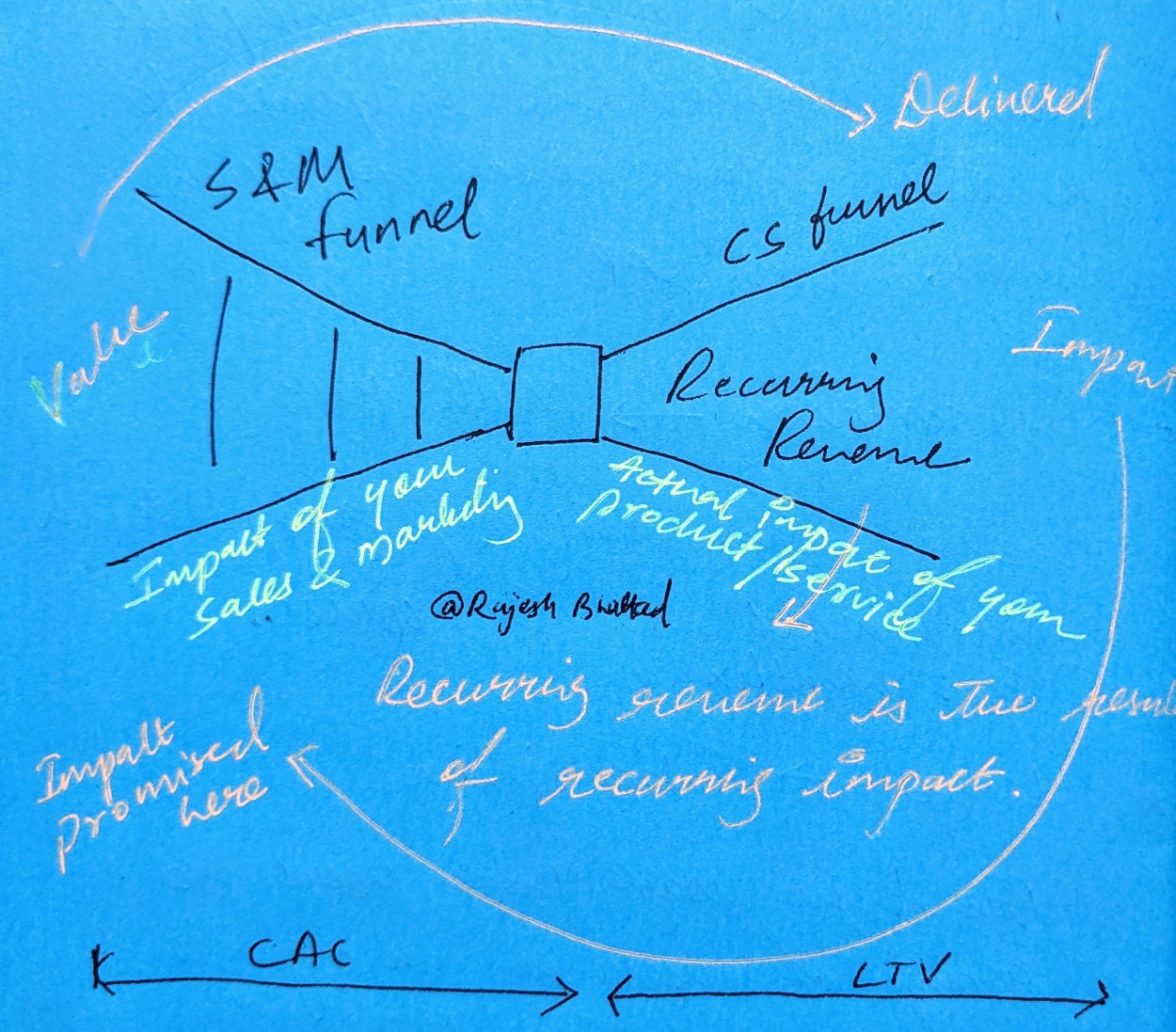

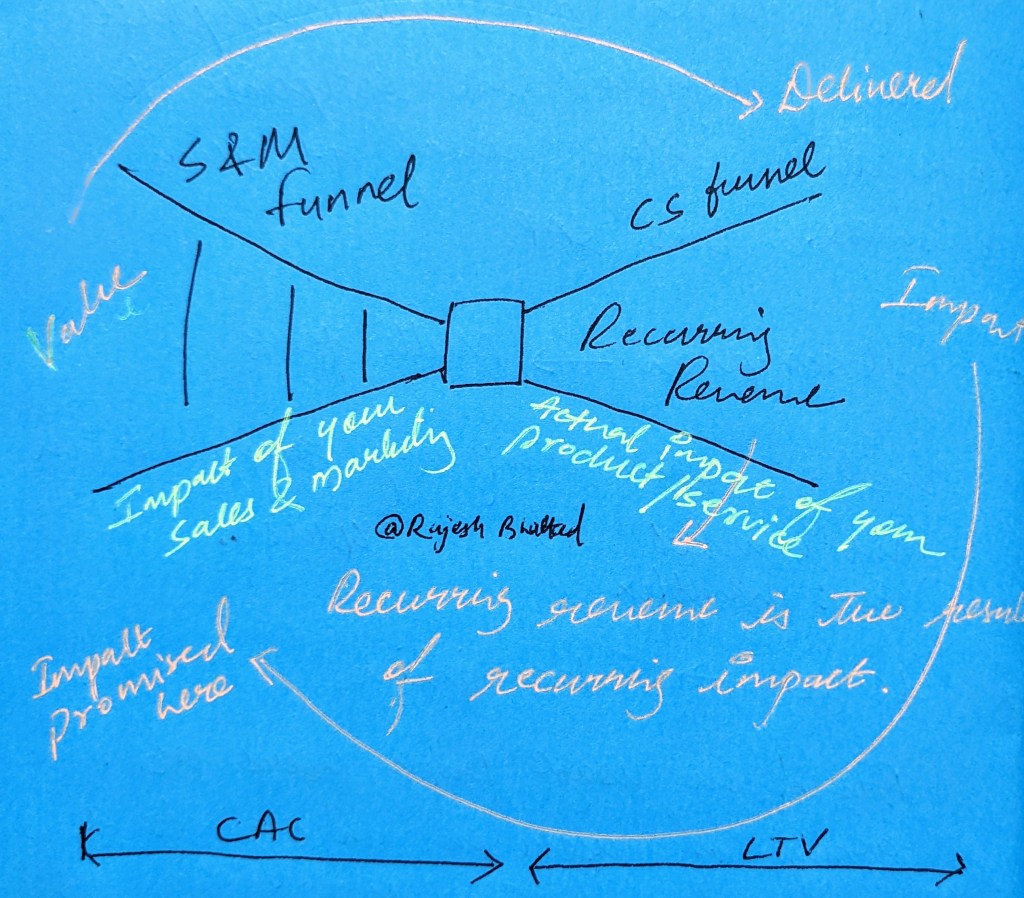

The typical funnel is a Sales and Marketing funnel, one that is trying to push the prospect into different sales stages and eventually to close. This is where you incur the cost of acquiring the customer (CAC).

Consider the following:

🔵 You are a $13M ARR organization

🔵 With an avg. ACV of $20K

🔵 It takes you $1250 to acquire every customer

🔵 Your MQL to Qualified Opps rate is at 30%

🔵 Your win rates are at 15%

Now suppose your NRR is 4% (below industry benchmark of 8%). Lets assume no complex upsell cross-sells here. Which means you will generate 4%*$13M=$530K in recurring revenue from your existing customers at no additional CAC.

Ask yourself this Q now: If I had to generate this same revenue from new business (going through the usual Sales & Marketing funnel), what would be my associated costs?

🔴 At $20K ACV, you would need 27 new deal closures to get $530K in revenues

🔴 That would cost you 27*$1250=$33,750 to acquire these customers

🔴 At 15% win rates, your sales team needs 180 qualified opportunities to work.

🔴 At 30% MQL to Qualified Opp rate, your SDR team needs 600 MQLs.

You could make more impact in the post-sales funnel and get more money from existing customers at no additional cost investment

OR

You could invest Qtrs in time and team in getting hundreds of MQLs to convert into Qualified Opps converting into a few dozen wins giving you the same outcome at a large cost.

🟢 Incentivize your sales and SDR on onboarding success vs Closed Wons

🟢 Align your sales and marketing pitch to promise value that your CSM can deliver and be held accountable for. Happier the customer, more the value they see in your product and services, more the money you will make from them.